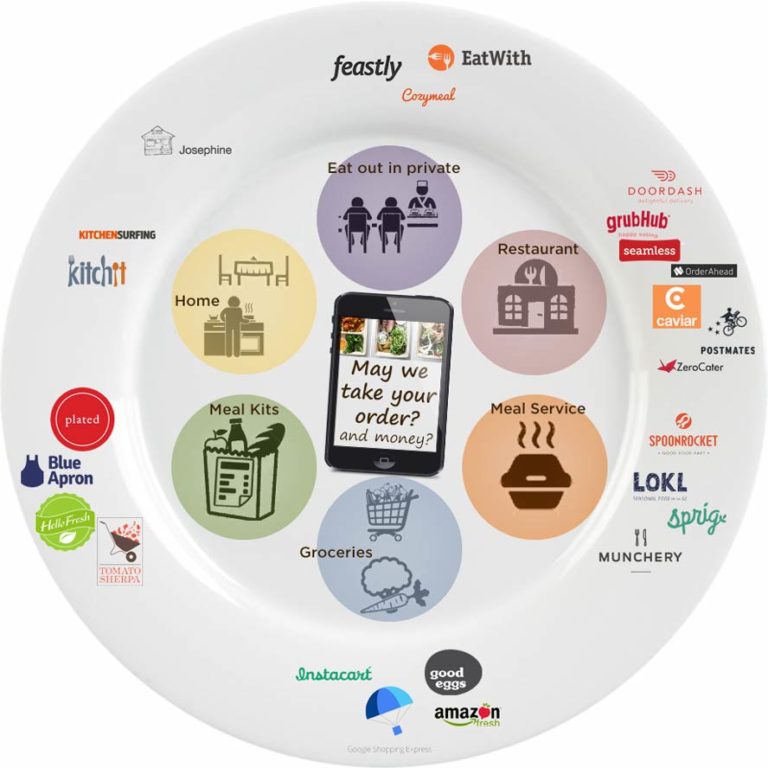

“What’s for dinner?” Of course, there’s an app for that.

“What’s For Dinner?” Of course, there’s an app for that. Airbnb and VRBO are changing how we travel. Lyft and Uber have definitely disrupted the taxi industry. What about the food

“What’s For Dinner?” Of course, there’s an app for that. Airbnb and VRBO are changing how we travel. Lyft and Uber have definitely disrupted the taxi industry. What about the food

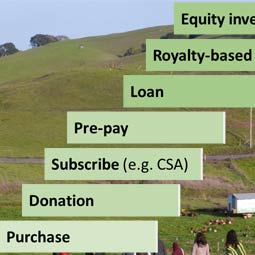

Slow Money investors have used various mechanisms to put money into sustainable food businesses. Here is a (simplified) overview about the seven main “modes”.

Fidelity, Schwab, TD Ameritrade and others are NOT designed to support diverse, small scale, physical investments that characterize local investing, be they royalty notes, promissory notes, convertible debt, equity, or some other structure.

That’s where Self-Directed IRA custodians come in.

Is there a better way to create and retain jobs in a community? Can we permanently anchor wealth formation in our communities? The answer is yes! Local communities and their local governments, whether at the municipal, county or state level, can use local investing as a powerful new economic development tool that retains jobs and economic benefits in the community for the long haul.

Let us dare to imagine an investor who has the sacred passion of an earthworm, slowly making his or her way through the soil of commerce and culture, playing a small, vital role in the maintenance of fertility.

Now, whether such notions have any practical import to the task of creating this new entity called Slow Money seems, at first, implausible. But it isn’t so.

Slow Money seeks to catalyze investments into the local foodshed and to bring about a new way of dealing with investments, one that is appropriate to place, based on direct relationships and aligned with the values of caring for the commons, sensitivity to the carrying capacity of the planet, and non-violence.